Wealth vs. Money

Resisting the Forces of Privatization and Commodification

by Robert C. Koehler

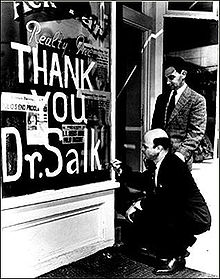

“There is no patent. Could you patent the sun?â€

The words are those of Jonas Salk, developer of the polio vaccine, speaking to Edward R. Murrow in 1955, as quoted recently in an essay by Paul Buchheit. What was he thinking? Six decades later, the words have such a counter-resonance with prevailing thought. They exude an old-fashioned humility and innocence, like . . . striking it rich isn’t necessarily the ultimate point of life?

The words are those of Jonas Salk, developer of the polio vaccine, speaking to Edward R. Murrow in 1955, as quoted recently in an essay by Paul Buchheit. What was he thinking? Six decades later, the words have such a counter-resonance with prevailing thought. They exude an old-fashioned humility and innocence, like . . . striking it rich isn’t necessarily the ultimate point of life?

I read these words and sense so much spilled wisdom in them, so much wasted hope. The world we’ve created is governed these days by two unquestioned principles: commodify and dominate. And it’s chewing up the resources that used to belong to every occupant of the planet.

“Eighty people hold the same amount of wealth as the world’s 3.6 billion poorest people, according to an analysis just released from Oxfam,â€Â Mona Chalabi wrote in January at FiveThirtyEight.com. “The report from the global anti-poverty organization finds that since 2009, the wealth of those 80 richest has doubled in nominal terms — while the wealth of the poorest 50 percent of the world’s population has fallen.â€

The winners keep winning and everyone loses.

Thus there is an “urgent need to tackle the vested interests of the 1 percent,†writes Winnie Byanyima, executive director of Oxfam International. Wealth is a wedge to maintain wealth and widen the gap between those who have and those who don’t. Wealth seeks to privatize the world and shut most people out.

“Wealth is used to entrench inequality, not to trickle down and solve it. . . .†she writes. “Across the world, we see that great money doesn’t only buy a nice car or a better education or healthcare. It can buy power: impunity from justice; an election; a pliant media; favourable laws. With the privatisation of our universities it can even buy the world of ideas.â€

It’s the opposite of the philosophy implicit in Salk’s comment: that what we do as individuals we do for the good of the whole, and, indeed, there is no separation between the individual and the whole. As Lewis Mumford once wrote, as quoted by Charles Eisenstein in his book Sacred Economics: “A patent is a device that enables one man to claim special financial rewards for being the last link in the complicated social process that produced the invention.â€

The point I’m reaching for is not about being nice or charitable but about how we need to notch up our sense of what it means to be realistic. We are not alone in this world. We are intricately and complexly connected to it, and we need a system of being — political, social, cultural and economic — fully and enthusiastically cognizant of this fact. We need to reorganize humanity around this awareness, especially economically, because the current system blinds us to this crucial reality.

“I believe we can build a human economy where people are the bottom line,†Byanyima writes, to which I would add: not just people but the whole planet. And it begins with a change in awareness: that wealth and money are not interchangeable concepts and, indeed, that wealth can be experienced but not, in fact, “held.†And the 80 billionaires who control the same amount of capital as the world’s 3.6 billion most impoverished residents may have corralled an astonishing amount of power over others but have wealth equal only to their level of spiritual awareness, which is an awareness that begins, perhaps, with a surrender of the self to the larger context in which we are alive.

You might call this context evolution. When we live our lives to the fullest, we contribute to the greater whole and this is the basis of spiritual fulfillment. It can’t be hoarded; it can’t be gamed; it’s not a zero-sum process, in which more spiritual fulfillment for me means less for you.

“What was once sacred to us . . . is becoming no longer sacred,â€Â Eisenstein said in an interview with Jonathan Talat Phillips. “For example, just a couple generations ago, we revered growth: the expansion of the human realm, the conquest of nature, etc. Today our values are changing, and we want to protect and heal nature. But money is still rooted in the old values. So, what I mean by ‘sacred economics’ is the realigning of money with those things that are becoming sacred to us today, those things that we deeply value.â€

So this is our dilemma: Money is still rooted in the old values. Civilization had a 6,000-year growth spurt propelled by domination and conquest of the planet and one another. We’re at the end of this spurt; we’re running out of what we can conquer, but we’re still enthralled to an economic system that insists that the conquests continue. We have to keep exploiting and privatizing the planet — “the commons,†as Eisenstein calls it — chopping it up and selling it back to one another. This is an economic system that insists on proclaiming winners (very few) and losers (the many). It’s an economic system that will sacrifice the public good when it’s time to do so, and that time has come.

In the spirit of resistance to this force, I celebrate Jonas Salk and his refusal to patent the polio vaccine. In doing so, I feel flooded with a sense of wealth.

Robert Koehler is an award-winning, Chicago-based journalist and nationally syndicated writer. His book, Courage Grows Strong at the Wound (Xenos Press), is still available. Contact him at koehlercw@gmail.com or visit his website at commonwonders.com.

What I do not understand is our fascinations with the ‘world’s richest’. Social Media and news media spend lots of time and space presenting and discussing the lifestyles of the wealthy elites. They are not particularly interested in the ‘poor’. And yet the majority of the world’s population are ‘poor. The norm is ‘poverty’.

1Oxfam tells us that 80 people control 50% of the global wealth. Forbes indicate that 1654 billionaires control 80% of global wealth.

1000 years of capitalism has rendered 7.2 billion people relatively ‘poor’. The UN reveal that 1 billion are starving!

What is even more perplexing is that the 1654 $billionaires, and the 12 million $millionaires seem to be indifferent to the unfairness of the distribution of wealth. The World Cup in 2014 clearly revealed that the football stars happily lived in their luxury mansions and drove their fleets of luxury cars amongst their poor neighbours without any regard for the injustices of their riches, and the possibilities of raising the standards of living of the communities by simply giving more to charity or even agreeing to earn less in fees and bonuses.

The poor majority seem to be trapped in a circle whereby their poverty is their own fault, and their inability to work hard and get ‘rich’.

But why would we want to get ‘rich’ and exploit the interests of the ‘poor’? How can we live in a world in which 7.2 billion are poor? trying to keep alive on less than $1 a day? or even trying to survive on less than ‘a living wage’?

THE MONEY GAME

There are two forms of money.

.First, cash; which is printed and minted by governments.

Second, there is digital money which is created out of nothing by loans from banks/mortgages/building societies/insurance groups/savings and loan companies.

In January 2015 it was calculated by the CIA/ the World Bank/ the IMF/the US Fed/ that the total global cash in circulation was $1.39 trillion. This is 3% of the total money in use. For a long time, Governments and their Central Banks have created money as cash [coins and notes]. They distribute cash to local banks. The value of the cash is measured in terms of the amounts in circulation [e.g. too much leads to /inflation; too little/ to deflation]. In this way governments control the supply of cash, and the value of the currency. It is no longer valued nor regulated against the ‘gold standard’.

Today, the 3% cash in circulation is to be found in our wallets and purses; even in the mattress; :in ATMs, pay packets, and shops. Banks do promise to pay cash to us on demand via an ATM or cash clerk.Your local bank will ask the Central Bank for cash by daily/weekly payments. The Central Bank will authorise the creation of notes, and coins.The amount of money as cash in circulation varies from country to country.

Another key source of cash is Gross Domestic Product: the income from sale of products by trading. All countries are involved in manufacturing or farming, trading products, ;buying and selling and generating profit. They depend upon their GDP to provide the cash to pay their debts, as well as to create surpluses with which to pay for government and corporate projects.

January 2015 the World Bank/CIA reports that $75.6 trillion is the global GDP.

. Today, of all the monies available to bankers and fund managers, 97% is digital/virtual. 3% is cash/coins/notes./gold. The numbers traded every day on ;the markets are many trillions in loans/in commodities/ currency exchange/ stock market dealings/ derivatives/ credit default swaps. It is estimated that more than $700 trillion is traded. every day, as digital money. This may be a $1 quadrillion on some days. During the 1980’s many banks across the world became deregulated, and;devised methods to create new money. Today, financial enterprises operate Fractional Reserve Banking which literally means that bank deposits need only be a fraction of the monies lent to customers. For example, a cash deposit of $1000 can be leveraged or multiplied by 100 to generate a loan of $100,000, and the loan deposit of 100,000 converted into $1,000,000; to form the basis of a total loan of $100,000,000

Fractional Reserve Banking enables corporations/companies/governments;to create millions to finance their major projects. The loan creates new money out of nothing. The debt is a contract to repay the loan money over a specific number of years.

Fractional Reserve Banking is at the core of modern capitalism, and acts as the driver for profit and growth. It enables banks to create digital money out of nothing. ;It enables banks to create money, free of the constraints of the Central Bank. Digital money does not depend upon the cash deposits in banks. Digital money can be manipulated, created, and transferred at the press of a keyboard. Creditors and debtors/ all customers, assume that this virtual money, will convert into cash.when required Fractional Reserve Banking is designed to offer loans and ;create new money out of nothing.

What is perplexing is that any $100 million loan, does not exist as cash in the bank. The original $1000 cash may be in a deposit account. But the new money exists in a ledger and on a computer screen and hard drive as a statement of account.It is virtual. It is digital.It is debt. It will become cash in the future when repayments are made; and when ;it is converted by the Central Bank.

.Today, money is best regarded as a set of numbers not a pack of notes nor a bag of coins..

Nevertheless, most customers of financial enterprises are convinced that all dealings are in cash backed by gold. ;But Banks are lending/spending trillions that exist in statements as numbers, not hard cash. The amounts available [liquidity] are supervised by the Central Banks.

The next step is the payment of interest. Bank profits are generated from the interest paid on the loans.The bigger the loan, the greater the interest.The amount of digital money lent has little to do with the amount of cash in circulation. Bankers and financiers and traders manipulate money numbers on a screen looking for a profit on all dealings: playing a money Game

Even though governments have the right to print money to meet their costs,most use Central Banks to organize and supervise their monies, to avoid inflation and deflation. Governments create cash ;but their demands are far greater and so ;most countries are in debt. Their National debts can be as high as $18 trillion, as in the USA, with interest payments of $500 billion per year; the UK, with 1.2 trillion GBP debts,has to meet 43 billion GBP annual interest. Other countries have large debts: Belgium $1.3 trillion; Japan, $1.5 trillion; France $1.7 trillion;China $1.9trillion; Ireland $1.8 trillion; Italy $2.2 trillion; Germany $2 trillion; Russia $76 billion. In order to pay their current debts the debtors choose to contract more debts to pay debts. and ;to reconcile the credits and the debits; the assets and income with the loans and the interest payments.

January 2015 the BBC reported that the total global debt is $200 trillion: all of which is digital money.. One of the rules of the money game is that debts are paid on time and in full. If this is not possible, debts are to be covered by more debts ;loans by more loans, interest payments by more interest. The debtor gets embroiled in a cycle of debt, and a system of compound interest. Recently, the USA was at the brink of bankruptcy when the Treasury was not able to pay the interest of $500 billion on a national debt of $18 trillion. This reminds us that most of the 195 countries in the world are in debt and need their GDP, profits, taxes, and growth to pay their debts! And all represent significant profits for the creditors on transactions that are trading virtual sums created and deleted at the push of a button.These transactions are politically significant in circumstances when a government has to raise taxes and to cut all social services in order to repay the interest on a loan; or when a government, like the USA, has borrowed so much that it can only afford to pay the annual interest, and therefore has to sell off national assets so as to remain solvent. Governments, such as Greece or Ireland or Portugal or Iceland or Spain or Italy, may have repaid the principal of their loans, but cannot pay the interest. This interest could be four times the principal! Ireland with a national debt of $1.8 trillion is facing interest payments of $7.2 trillion; or Italy, $8.8 trillion interest. These are all inconceivable amounts of money: particularly for countries that are barely covering their costs.

2I find it difficult to comprehend a system in which nearly all the ‘money’ and therefore the ‘wealth’ is created out of nothing. Does this mean that the riches of the billionaires and millionaires are ‘make-believe’? as they play ‘the Money Game’?